What is a Downtown Development Authority?

- Local governmental entity managed by a board of directors that guides the implementation of a downtown development plan

- Can use financial tools, including TIF, operating mill levy

- Has the ability to finance long-term improvement bonds

- Can leverage other sources of funds for downtown improvements

- While a DDA can address blight and is encouraged to do so, it does NOT have the power of eminent domain

How is a DDA formed?

- Finalize a downtown development plan

- Plan is approved by Town Council

- Following an election within the affected area, DDA is formed by Town Council

- Authorization to use financial tools requires a majority vote of stakeholders within the DDA boundary – property owners and business lessees

How Does the DDA Work with the Town?

- Town Council appoints DDA board of directors

- DDA must provide annual report to Town Council

- DDA and Town can develop agreements to govern use of TIF

- Town Council has power to disband DDA by ordinance if there are no outstanding bonds or other financial obligations

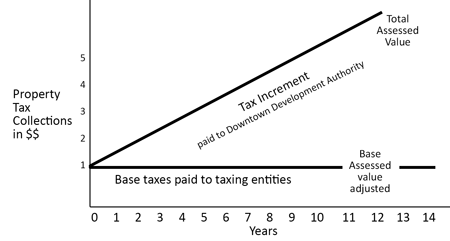

What is Tax Increment Financing or TIF?

- TIF is a way to use revenues from future increases in sales and/or property taxes to finance downtown improvements today

- A base year is established

- Current taxes continue to be allocated to county, schools and town

- Future increase in tax revenues is an “increment” that must be reinvested in downtown improvements

- TIF does not constitute a tax increase, only a re-allocation of existing tax revenues

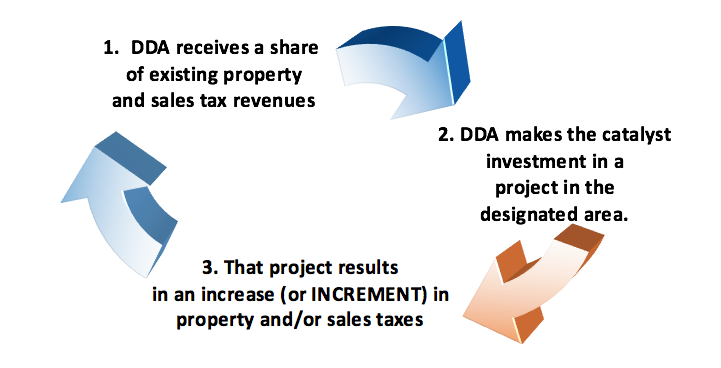

Tax Increment Financing Cycle

What is an Operational Mill Levy?

- In addition to collecting and investing TIF, a DDA can create a mill levy (i.e. property tax) to support operations with the approval of DDA voters

- Operations includes DDA administration, plus can include downtown planning, marketing, maintenance and capital replacement

- A DDA mill levy cannot exceed 5 mills

- Any proposed mill levy is subject to a vote by all affected property owners, lessees and residents

Why would a downtown need a DDA?

- A self-sustaining champion for downtown

- Has the ability to create and use financial tools (i.e. TIF and mill levy)

- Has the ability to leverage other sources of funds to help finance downtown improvements

- Can be the key to implementing the downtown vision and plan

Uses for TIF Dollars

- Tax Increment Financing (TIF) is a unique mechanism that enables a Downtown Development Authority (DDA) to use the net new tax revenues generated by projects within a designated area to help finance future improvements. TIF is a new source of tax revenue, not an additional tax, that would not be available but for new investment.

- TIF keeps the tax dollars from going into the general funds and instead re-invests these funds into investments to improve the property and services within the DDA area.

- Focusing on improvements in a downtown area will increase sales tax and property taxes that go back into the town’s general fund for improvements throughout the whole town.